![]() Richard C.: Explains how the average American has been fleeced by big finance & the rich over the last 50 decades, starting with Ronald Reagan, & successive administrations since. The successful lobbying, watering down, or outright eliminating safeguards & laws enacted since the last depression, for just 1 example, to limit abuses & excesses by financial institutions leading to what we saw in 2008 with the mortgage baloney.

Richard C.: Explains how the average American has been fleeced by big finance & the rich over the last 50 decades, starting with Ronald Reagan, & successive administrations since. The successful lobbying, watering down, or outright eliminating safeguards & laws enacted since the last depression, for just 1 example, to limit abuses & excesses by financial institutions leading to what we saw in 2008 with the mortgage baloney.

Canada on Aug 12, 2019

![]() Kieran Roberts: Book was in good shape when it arrived, no complaints

Kieran Roberts: Book was in good shape when it arrived, no complaints

United Kingdom on Feb 10, 2018

![]() badams: fantastic reading! covers a lot of topics and can seem to jump around a bit, but there is a tremendous about of depth in each area.

badams: fantastic reading! covers a lot of topics and can seem to jump around a bit, but there is a tremendous about of depth in each area.

United Kingdom on Jan 20, 2016

![]() Sayo: Matt tells a fascinating story here, full of detailed intrigue and executive connivance. But the real story is that those most affected by the amoral conduct of Wall Street will do little about it, other than a little symbolic "pissing in the wind." There is an old saying, "Collectively, as a society, you get the government you deserve." Today's America, and the rest of the West in large measure, have not been subjected to the brutalities that their forefathers experienced. The West, collectively, no longer has the requisite intestinal fortitude to confront such difficulties. Crime is crime, whether perpetrated by well dressed corporate executives in suits or heavily armed men in full leathers. Crime injures both its immediate victims and the broader societies to whom they belong. And as USA no longer has the necessary internal fortitude to confront corporate crime, it will as it must, continue to suffer even greater injury. A tragic outcome for your Republic and one entirely of your own making.

Sayo: Matt tells a fascinating story here, full of detailed intrigue and executive connivance. But the real story is that those most affected by the amoral conduct of Wall Street will do little about it, other than a little symbolic "pissing in the wind." There is an old saying, "Collectively, as a society, you get the government you deserve." Today's America, and the rest of the West in large measure, have not been subjected to the brutalities that their forefathers experienced. The West, collectively, no longer has the requisite intestinal fortitude to confront such difficulties. Crime is crime, whether perpetrated by well dressed corporate executives in suits or heavily armed men in full leathers. Crime injures both its immediate victims and the broader societies to whom they belong. And as USA no longer has the necessary internal fortitude to confront corporate crime, it will as it must, continue to suffer even greater injury. A tragic outcome for your Republic and one entirely of your own making.

Of course the present outcome would not have been possible without the generations of indifference to the actions of the Supreme Court of the United States. If the financial...

Australia on Jan 03, 2016

![]() Xerxes: If you're interested in the nature of the financial leviathan that strangles our political/economy, this is the book for you. Don't be intimidated by the content, Taibbi turns what would be usually considered wonk-ish into an enjoyable book.

Xerxes: If you're interested in the nature of the financial leviathan that strangles our political/economy, this is the book for you. Don't be intimidated by the content, Taibbi turns what would be usually considered wonk-ish into an enjoyable book.

Canada on Jun 20, 2014

![]() zstopperuno: America's biggest financial bubble burst in 1929 and then the bubbles went away for fifty years until they started re-appearing in the 1980's as the American economy became increasingly bubblicious, leading to the crash of 2008. The book Griftopia by Matt Taibbi is the story of how the grifter class brought the bubbles back through a campaign of political lobbying aimed at both policy-makers and the general public.

zstopperuno: America's biggest financial bubble burst in 1929 and then the bubbles went away for fifty years until they started re-appearing in the 1980's as the American economy became increasingly bubblicious, leading to the crash of 2008. The book Griftopia by Matt Taibbi is the story of how the grifter class brought the bubbles back through a campaign of political lobbying aimed at both policy-makers and the general public.

The key to reviving a bubblicious financial system was getting rid of the regulations designed to prevent bubbles. In order to sell the de-regulatory proposals it was necessary to offer something in their place, and that something was the concept of self-regulation. As ridiculous as the concept sounds, the advertising campaign for it was successful and this book provides an insightful explanation as to how it was done.

Taibbi gives us an excellent example with Alan Greenspan of the disconnect between what we're sold and what we actually get. As Taibbi writes, "Greenspan's rise to the top is one of the great scams of our time. His career is the perfect prism through which one can see the twofold basic deception of American politics: a system that preaches...

United States on May 19, 2011

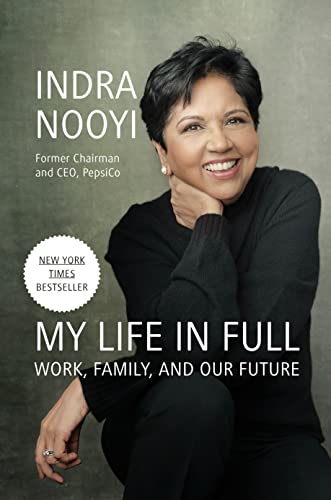

| Griftopia: Uncovering the Corrupt Practices That Are Plundering America | Thomas Sowell's "Basic Economics: Principles and Policy" (Page 127) | Indra Nooyi: Achieving Balance in Work, Family, and Our Future | |

|---|---|---|---|

|

|

|

|

| B2B Rating |

76

|

96

|

95

|

| Sale off | $13 OFF | $10 OFF | |

| Total Reviews | 13 reviews | 188 reviews | 135 reviews |

| Communication & Media Studies | Communication & Media Studies | ||

| Political Commentary & Opinion | Political Commentary & Opinion | ||

| ISBN-13 | 978-0385529952 | 978-0465060733 | 978-0593191798 |

| Language | English | English | English |

| ISBN-10 | 0385529953 | 9780465060733 | 059319179X |

| Hardcover | 272 pages | 704 pages | 320 pages |

| Publisher | Spiegel & Grau; First Edition | Basic Books; 5th ed. edition | Portfolio |

| Item Weight | 1.05 pounds | 2.18 pounds | 1.15 pounds |

| Customer Reviews | 4.6/5 stars of 934 ratings | 4.9/5 stars of 4,400 ratings | 4.6/5 stars of 4,070 ratings |

| Dimensions | 6.5 x 1.25 x 9.75 inches | 6.5 x 2.13 x 9.5 inches | 6.27 x 1.09 x 9.31 inches |

| Best Sellers Rank | #1,654 in Economic Conditions #1,918 in Political Commentary & Opinion#3,303 in Communication & Media Studies | #2 in Political Economy#3 in Theory of Economics#4 in Economic Conditions | #75 in Women & Business #231 in Business Professional's Biographies#1,932 in Memoirs |

| Economic Conditions (Books) | Economic Conditions | Economic Conditions |

If you want to understand how this happened, a good place to start is with Alan Greenspan. He is the human embodiment of a political and economic hypocrite; the trends he set during his twenty-year tenure as President of the Federal Reserve have left us with a broken system. On the one hand, he preached free market economics, while on the other hand he gave massive governmental bailouts to the banks on Wall Street. These two ideas cannot co-exist, as the definition of a free market is one with no financial safety net. It is a...

United States on Feb 02, 2021