How to Choose the Financial & Business Office Calculators

Unlocking Efficiency: The Role of Financial and Business Office Calculators

- 1. Unlocking Efficiency: The Role of Financial and Business Office Calculators

- 1.1. The Role of Financial and Business Office Calculators

- 1.1.1. Basic Arithmetic Operations

- 1.1.2. Time Value of Money (TVM) Calculations

- 1.1.3. Discounted Cash Flow (DCF) Analysis

- 1.1.4. Percentages and Markup/Markdown Calculations

- 1.1.5. Statistical and Mathematical Functions

- 1.1.6. Cost-Sell-Margin Calculations

- 1.1.7. Currency Conversion

- 1.1.8. Loan and Mortgage Calculations

- 1.1.9. Tax Calculations

- 1.1.10. Profitability and Return Metrics

- 1.2. Types of Financial and Business Office Calculators

- 1.2.1. Basic Calculators

- 1.2.2. Scientific Calculators

- 1.2.3. Financial Calculators

- 1.2.4. Graphing Calculators

- 1.2.5. Printing Calculators

- 1.3. Benefits of Financial and Business Office Calculators

- 1.3.1. Accuracy and Precision

- 1.3.2. Time Efficiency

- 1.3.3. Financial Planning and Analysis

- 1.3.4. Streamlined Loan Management

- 1.3.5. Educational Tool

- 1.4. Consideration When Choosing A Financial & Business Office Calculator

- 1.4.1. Functionality

- 1.4.2. Ease of Use

- 1.4.3. Display

- 1.4.4. Power Source

- 1.4.5. Programmability

- 1.4.6. Compatibility

- 1.5. Conclusion

- 1.1. The Role of Financial and Business Office Calculators

Businesses rely on financial and business office calculators as indispensable instruments for handling intricate financial computations. These calculators are specifically crafted to deliver the accuracy and features necessary for making informed financial decisions, ranging from interest rate calculations to the analysis of statistical data and the modeling of mathematical equations. Whether you are tasked with currency conversions or determining investment values, a financial and business office calculator proves to be the ideal tool for the job. This article delves into the importance of these calculators, their diverse types, and their role in boosting productivity within the corporate realm.

The Role of Financial and Business Office Calculators

Financial and business office calculators play a crucial role in various financial and business operations. These specialized calculators are designed to perform specific functions related to financial calculations, which are essential for accurate decision-making and efficient workflow in business settings. Here are some key roles and functions of financial and business office calculators:

Basic Arithmetic Operations

Financial calculators can perform basic arithmetic operations such as addition, subtraction, multiplication, and division. This functionality is fundamental for a wide range of financial calculations.

Time Value of Money (TVM) Calculations

TVM calculations involve the evaluation of cash flows over time, considering factors such as interest rates, present value, future value, annuities, and loan amortization. Financial calculators are equipped with specialized functions to simplify these complex calculations.

Discounted Cash Flow (DCF) Analysis

DCF analysis is used to evaluate the present value of future cash flows. Financial calculators assist in discounting future cash flows to their present value, helping businesses make investment decisions.

Percentages and Markup/Markdown Calculations

Calculating percentages and determining markup or markdown on prices are common tasks in business. Financial calculators streamline these calculations, saving time and reducing the likelihood of errors.

Statistical and Mathematical Functions

Some financial calculators include statistical and mathematical functions useful for data analysis and forecasting. These functions may include mean, standard deviation, regression analysis, and more.

Cost-Sell-Margin Calculations

Businesses often need to calculate the cost of a product, the selling price, and the associated profit margin. Financial calculators simplify these calculations, aiding in pricing decisions.

Currency Conversion

In an increasingly globalized business environment, currency conversion is a common requirement. Some financial calculators have built-in currency conversion functions, allowing quick and accurate conversions.

Loan and Mortgage Calculations

Financial calculators are widely used to calculate loan payments, interest rates, and amortization schedules. This is valuable for individuals and businesses managing loans and mortgages.

Tax Calculations

Calculating taxes, especially in complex financial scenarios, can be challenging. Financial calculators assist in determining tax liabilities and planning tax strategies.

Profitability and Return Metrics

Financial calculators help businesses assess profitability by calculating metrics such as return on investment (ROI), return on equity (ROE), and net present value (NPV).

Types of Financial and Business Office Calculators

Basic Calculators

Basic calculators are the foundation of every office. They perform fundamental arithmetic operations like addition, subtraction, multiplication, and division. While basic in function, they are indispensable for quick calculations and are often used in tandem with more advanced calculators.

Scientific Calculators

Scientific calculators go beyond basic arithmetic and offer functions such as logarithms, trigonometric calculations, and statistical operations. These calculators are essential for professionals in fields like engineering, science, and finance, where complex calculations are routine.

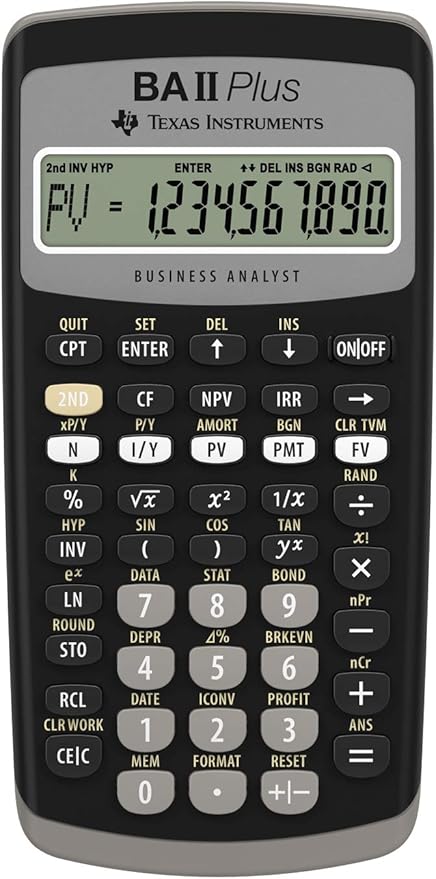

Financial Calculators

Specifically designed for financial professionals, these calculators streamline various financial computations. They can calculate present and future values, analyze cash flows, and determine interest rates. Financial calculators are invaluable for tasks like investment analysis, loan amortization, and time value of money calculations.

Graphing Calculators

Graphing calculators are widely used in education and business. They not only perform advanced mathematical calculations but also allow users to visualize data through graphs and charts. This feature is particularly beneficial for professionals analyzing trends and patterns in financial data.

Printing Calculators

Printing calculators combine the functionality of basic calculators with the ability to print a record of calculations. This feature is crucial for financial professionals who need hard copies for documentation and record-keeping.

Benefits of Financial and Business Office Calculators

Accuracy and Precision

Financial calculations demand a high degree of accuracy. Business office calculators provide precise results, minimizing the risk of errors that can have significant financial implications.

Time Efficiency

Time is of the essence in the business world. These calculators allow professionals to perform complex calculations swiftly, freeing up time for more strategic tasks and decision-making.

Financial Planning and Analysis

Financial calculators are essential tools for financial planning and analysis. Professionals can assess the feasibility of investments, project future cash flows, and make strategic decisions based on accurate financial data.

Streamlined Loan Management

For businesses and individuals alike, managing loans and understanding repayment schedules is simplified with financial calculators. Loan amortization calculations help in planning and budgeting for repayments.

Educational Tool

Financial and business calculators serve as educational tools, aiding students and professionals in understanding complex financial concepts. Their user-friendly interfaces make them accessible for individuals at various levels of expertise.

Consideration When Choosing A Financial & Business Office Calculator

Functionality

Financial Functions: Ensure that the calculator provides a comprehensive set of financial functions. Look for features such as time value of money (TVM), interest rate conversions, cash flow analysis, and NPV (Net Present Value). These functions are fundamental for financial analysis and decision-making.

Business Functions: Consider features relevant to business calculations, including profit margin calculations, cost/sell/margin calculations, and depreciation functions. A calculator with a robust suite of business functions can streamline complex computations common in the business world.

Ease of Use

- User Interface: Opt for a calculator with a user-friendly interface. Check if it has intuitive buttons and a clear display. Consider whether the calculator uses a menu-driven system or provides direct access keys for common functions, as this can significantly impact ease of use.

- Keypad: Examine the layout and size of the keypad, especially for frequently used functions. A well-designed keypad can enhance the overall user experience and reduce the likelihood of input errors.

Display

- Size and Clarity: Choose a calculator with a larger, clear display. A readable display is essential for avoiding mistakes in calculations. For complex computations, consider a calculator with a multiline display.

- Backlight: If you anticipate using the calculator in low-light conditions, consider a model with a backlight for the display. This feature enhances visibility and usability in various environments.

Power Source

- Battery Life: If the calculator is battery-powered, check the estimated battery life. Some calculators come with a solar panel for supplementary power, which can extend battery life and reduce the frequency of replacements.

- Solar Power: Consider a solar-powered calculator to reduce the environmental impact and the need for frequent battery changes. Solar power can be a sustainable and convenient option.

Programmability

- User Memory: Some advanced calculators allow users to store and recall data. Determine if this feature is important for your calculations, as it can be beneficial for saving time and maintaining accuracy.

- Programming Capability: If you frequently perform specific calculations, check if the calculator allows for custom programming. This feature can be a game-changer for users with specialized calculation requirements.

Compatibility

Connectivity: Assess the calculator's connectivity options, such as USB or other interfaces for data transfer. Connectivity can be advantageous if you need to link the calculator to a computer or other devices for data exchange.

Conclusion

The significance of financial and business office calculators cannot be emphasized enough. These instruments not only ensure precise and swift calculations but also play a pivotal role in facilitating well-informed decision-making, strategic planning, and heightened productivity. With the ongoing advancements in technology, it is probable that these calculators will undergo further developments to cater to the progressively intricate requirements of financial professionals, solidifying their status as indispensable tools in the corporate realm.