How to Choose the Check Writers

Everything You Need To Know Before Choosing A Check Writer

- 1. Everything You Need To Know Before Choosing A Check Writer

- 1.1. What is a Check Writer?

- 1.2. Benefits Of Using A Check Writer

- 1.2.1. Convenience and Streamlined Process

- 1.2.2. Security and Fraud Prevention

- 1.2.3. Flexibility and Universal Acceptance

- 1.2.4. Cost-Efficiency

- 2. Things to Consider When Buying a Check Writer

- 2.1. Compatibility

- 2.2. Security Features

- 2.3. User-Friendliness

- 2.4. Printing Quality

- 2.5. Maintenance and Support

- 2.6. Cost

In the era of digital technology and the prevalence of electronic payments and online banking, the unassuming check writer often goes unnoticed. Nevertheless, this time-honored instrument continues to stand firm as a dependable and user-friendly means of conducting financial transactions. Whether you are settling bills, completing purchases, or merely transferring funds, check writers provide a tangible and secure avenue for managing your finances.

What is a Check Writer?

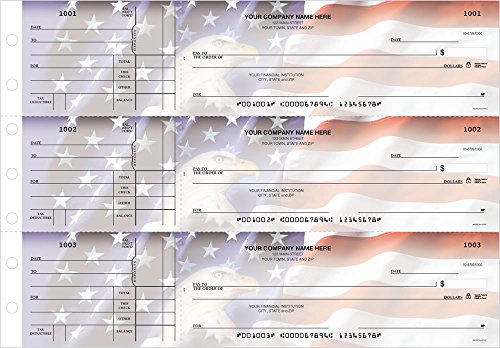

A check writer, alternatively referred to as a check printer or check machine, is a tool employed for generating checks. It streamlines the task of producing checks by imprinting essential details, including the recipient's name, the monetary sum, and the date, onto pre-designed check paper. While businesses primarily utilize check writers, individuals can also find them advantageous due to their convenience.

Benefits Of Using A Check Writer

Convenience and Streamlined Process

Utilizing a check writing machine offers a host of advantages, with convenience standing as a primary benefit. Instead of the laborious and error-prone task of manually filling out each check, a check writing machine simplifies the entire process. With just a few keystrokes, you can input the necessary details, and the device swiftly produces a professionally formatted check within seconds.

Furthermore, check writing machines often include built-in features that enhance efficiency. They can store payee information, enabling swift retrieval and printing of checks for recurring payments. Some models even possess the capability to print multiple checks simultaneously, significantly saving time when handling bulk payments.

Security and Fraud Prevention

Despite the prevalence of electronic transactions, concerns about security and fraud persist. Check writing machines bolster security by providing tangible proof of payment. When a check is written, it generates a physical record of the transaction, simplifying tracking and financial reconciliation.

Additionally, check writing machines frequently incorporate security features to thwart fraud. These features may comprise watermarks, microprinting, and special inks that deter unauthorized alterations or counterfeiting attempts. Utilizing a check writing machine helps minimize the risk of fraudulent activity and safeguards against potential financial losses.

Flexibility and Universal Acceptance

Another advantage of employing check writing machines lies in the flexibility they afford. Unlike electronic payments, which necessitate compatible systems on both ends, checks enjoy universal acceptance. Whether you're making payments to a small vendor, a utility company, or an individual, checks are widely recognized as a valid form of payment.

Furthermore, checks provide flexibility in terms of timing. Electronic payments often transfer funds immediately, offering little room for adjustments. In contrast, check writing allows for more control over payment timing. You can postdate a check to a future date, enabling more effective management of your cash flow.

Cost-Efficiency

Using check writing machines can also prove cost-effective, particularly for businesses issuing a substantial number of checks. By printing checks in-house, you can reduce expenses linked to ordering pre-printed checks from banks or third-party suppliers. Moreover, check writing machines eliminate the need for manual check preparation, reducing labor costs while enhancing overall efficiency.

Things to Consider When Buying a Check Writer

Investing in a check writer can be a time and effort-saving decision. However, given the abundance of options on the market, it's essential to take into account several key factors before committing to a purchase. Here are some factors to contemplate when in the process of acquiring a check writer:

Compatibility

Before you buy a check writer, make certain it is compatible with your existing accounting software or printer. Some check writers are specifically designed to work seamlessly with particular software, while others offer more flexibility. Review the specifications and compatibility requirements to preempt any compatibility issues in the future.

Security Features

Checks are a prime target for fraudulent activities, so it's imperative to select a check writer that incorporates robust security features. Seek out attributes like microprinting, which renders check replication difficult, and security patterns that deter unauthorized alterations. Furthermore, consider a check writer equipped with built-in encryption to safeguard sensitive information.

User-Friendliness

A check writer should streamline the check-writing process, so it's crucial to opt for one that is user-friendly. Search for a model with an intuitive interface and clear instructions. Some check writers even provide customizable templates, allowing you to store frequently used payee information for swift and effortless check composition.

Printing Quality

The quality of the checks produced is another pivotal consideration. Choose a check writer that delivers clear, professional-looking checks. Pay close attention to resolution and printing speed to ensure legibility and efficient printing.

Maintenance and Support

Similar to any other equipment, a check writer may require periodic maintenance or encounter technical hiccups. Prior to making a purchase, assess the availability of customer support and the ease of procuring replacement parts or ink cartridges. Delve into reviews or seek recommendations to ensure the chosen check writer comes with a dependable support system.

Cost

The cost of check writers can fluctuate based on the brand, model, and available features. Typically, check writers are priced between approximately $50 and several hundred dollars. Simple models with restricted features are usually more budget-friendly, whereas sophisticated models offering extra functionalities may come at a higher cost. It's important to evaluate the enduring advantages and potential financial benefits that come with investing in a dependable and efficient check writer.

In conclusion, despite the revolutionary impact of electronic payments on financial transactions, check writers still provide a convenient and secure method for handling finances. Their efficiency, security features, flexibility, and cost-effectiveness make check writers a valuable tool for both individuals and businesses alike. When making payments in the future, it's worth considering the advantages of utilizing a check writer to enjoy the simplified and secure experience it offers for financial transactions.