How to Choose the Valuation Books

Hi dear! Are you finding Valuation books? Today, I’m Jane Smith will share you some tips for choosing vegetable cooking books? Let’s explore!

- 1. What are Valuation Books?

- 2. Purposes of Valuation books

- 2.1. Financial Reporting

- 2.2. Taxation

- 2.3. Mergers and Acquisitions

- 2.4. Litigation and Dispute Resolution

- 2.5. Financial Planning and Investment

- 2.6. Insurance

- 2.7. Financial Risk Management

- 3. Types of Valuation Books

- 4. Benefits of Valuation Books

- 4.1. Informed Decision-Making

- 4.2. Transparency

- 4.3. Legal and Regulatory Compliance

- 4.4. Fair Market Value Determination

- 4.5. Risk Management

- 4.6. Estate Planning and Probate

- 4.7. Insurance Coverage

- 4.8. Mergers and Acquisitions

- 4.9. Financial Reporting Accuracy

- 4.10. Investor Confidence

- 4.11. Lending and Credit Decisions

- 4.12. Strategic Planning

- 4.13. Litigation Support

- 5. How to choose Valuation Books?

- 5.1. Determine the Purpose of Valuation:

- 5.2. Identify the Type of Asset or Business:

- 5.3. Check Qualifications and Credentials:

- 5.4. Experience and Expertise:

- 5.5. Reputation and References:

- 5.6. Quality of Previous Work:

- 5.7. Fee Structure:

- 5.8. Methodology and Approach:

- 5.9. Communication and Rapport:

- 5.10. Confidentiality and Data Security:

- 5.11. Compliance and Regulation:

- 5.12. Timeline and Deliverables:

- 5.13. Conflict of Interest:

- 5.14. Client References:

- 5.15. Contract and Engagement Agreement:

- 6. In conclusion

What are Valuation Books?

Valuation books, also known as valuation reports or appraisal reports, are documents that provide an estimate of the monetary value of a particular asset, business, property, or investment.

Purposes of Valuation books

These reports are typically prepared by professionals known as appraisers or valuators and are used for a variety of purposes, including:

Financial Reporting

Valuation books are often required for financial reporting purposes, such as determining the fair value of assets and liabilities for accounting and disclosure in financial statements. This is particularly important for companies that follow accounting standards like International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP).

Taxation

Valuation books can be used for tax-related purposes, such as calculating property taxes, estate taxes, gift taxes, or capital gains taxes. Valuation reports help establish the value of assets for tax assessment.

Mergers and Acquisitions

When businesses are bought or sold, valuation reports play a crucial role in determining the purchase price or the value of the business being acquired. These reports help negotiate the terms of the transaction.

Litigation and Dispute Resolution

In legal proceedings, valuation books can be used as evidence to support claims related to the value of assets, properties, or businesses in cases such as divorce settlements, shareholder disputes, or eminent domain cases.

Financial Planning and Investment

Investors and financial planners may use valuation reports to assess the value of investments, portfolios, or assets. This information helps in making informed investment decisions.

Insurance

Valuation books can be used by insurance companies to determine the appropriate coverage and premiums for insuring assets, such as buildings, art collections, or valuable possessions.

Financial Risk Management

Banks and financial institutions use valuation reports to assess the value of collateral when issuing loans or assessing credit risk.

Valuation books typically contain detailed information about the methodology used to determine the value of the asset or business, including relevant market data, comparable sales, income projections, and various financial metrics. The appraiser or valuator follows established valuation principles and standards to ensure accuracy and objectivity.

Types of Valuation Books

Valuation books, or valuation reports, can take various forms depending on the type of asset or business being valued and the purpose of the valuation. Here are some common types of valuation books:

Business Valuation Report:

- Going Concern Valuation: This type of report assesses the total value of a business as a going concern, taking into account its assets, liabilities, cash flow, and future earning potential.

- Asset-Based Valuation: This report focuses on the value of a business's tangible and intangible assets, such as equipment, real estate, patents, trademarks, and brand value.

- Income Approach Valuation: This approach estimates the value of a business based on its expected future cash flows, discounted to present value using a suitable discount rate.

- Market Approach Valuation: This approach compares the subject business to similar businesses in the market to determine its value. Common methods include the use of comparable company analysis (CCA) or precedent transactions analysis (PTA).

Real Estate Valuation Report:

- Appraisal Report: This report estimates the value of a specific real estate property, taking into account factors like location, size, condition, and comparable property sales in the area.

- Rental Valuation: This type of report assesses the potential rental income and value of income-producing properties, such as apartment buildings or commercial spaces.

- Cost Approach Valuation: This approach calculates the value of a property based on the cost to replace it with a similar property at current market prices.

Asset Valuation Report:

- Tangible Asset Valuation: This report assesses the value of tangible assets like machinery, equipment, vehicles, and inventory.

- Intangible Asset Valuation: For assets without a physical presence, such as patents, copyrights, trademarks, and intellectual property, this report estimates their value based on their contribution to future earnings.

Financial Asset Valuation Report:

- Securities Valuation: This report determines the fair market value of financial securities like stocks, bonds, options, and derivatives.

- Portfolio Valuation: Investment managers and financial institutions use this report to assess the value of investment portfolios, including stocks, bonds, and other assets.

Personal Property Valuation Report:

- Estate Valuation: This report estimates the value of personal assets such as jewelry, art, antiques, and collectibles for estate planning or probate purposes.

- Insurance Valuation: For insurance purposes, a report may be prepared to determine the replacement value of personal property in case of loss or damage.

Specialized Valuation Reports:

- Mineral and Natural Resource Valuation: These reports assess the value of mineral rights, oil and gas reserves, and other natural resources.

- Brand Valuation: Focused on the value of a brand's reputation and customer loyalty, this report is often used for marketing and brand management purposes.

Each type of valuation report may require different methodologies and approaches to arrive at an accurate estimate of value. The specific format and content of these reports can vary based on industry standards, regulatory requirements, and the needs of the client or stakeholder requesting the valuation. Appraisers and valuators typically tailor their reports to suit the unique characteristics of the asset or business being valued.

Benefits of Valuation Books

Valuation books, or valuation reports, offer several important benefits to individuals, businesses, and organizations across various contexts. Here are some of the key advantages of having valuation books:

Informed Decision-Making

Valuation books provide valuable information about the estimated value of assets, businesses, or investments. This information helps individuals and organizations make informed decisions regarding purchases, sales, investments, and financial planning.

Transparency

Valuation reports provide a transparent and documented assessment of an asset's or business's value. This transparency can be crucial in negotiations, legal proceedings, or financial transactions, as it reduces the likelihood of disputes or misunderstandings.

Legal and Regulatory Compliance

In many cases, valuation reports are required to comply with legal and regulatory requirements. For example, businesses often need valuation reports for financial reporting, tax purposes, and compliance with accounting standards.

Fair Market Value Determination

Valuation books help determine the fair market value of assets and businesses. This is particularly important for tax purposes, as it ensures that taxes are assessed fairly based on the current market value of assets.

Risk Management

In financial and investment contexts, valuation reports assist in assessing and managing risks. Investors can use these reports to understand the value of their investment portfolios and make risk-adjusted decisions.

Estate Planning and Probate

Valuation reports are essential in estate planning to determine the value of assets for distribution among heirs. They help ensure that assets are distributed fairly and in accordance with the deceased's wishes.

Insurance Coverage

For insurance purposes, valuation reports help individuals and businesses determine the appropriate coverage for their assets. In the event of loss or damage, having an accurate valuation can facilitate a smoother claims process.

Mergers and Acquisitions

In mergers and acquisitions (M&A) transactions, valuation reports are critical for negotiating the purchase price and terms. They provide a basis for determining the value of the target company and its assets.

Financial Reporting Accuracy

Valuation reports contribute to the accuracy of financial statements. When businesses report their assets, liabilities, and equity at their fair values, stakeholders have a more realistic view of the company's financial health.

Investor Confidence

Investors and stakeholders often have more confidence in businesses and investments when they are backed by professional valuation reports. These reports provide an objective and credible assessment of value.

Lending and Credit Decisions

Banks and financial institutions use valuation reports to assess the value of collateral offered by borrowers. This information helps in making lending and credit decisions.

Strategic Planning

Businesses can use valuation reports as a strategic planning tool. Understanding the value of assets and investments helps in setting goals, allocating resources, and developing growth strategies.

Litigation Support

In legal disputes, valuation reports can serve as critical evidence to support claims related to asset value, damages, or financial losses.

How to choose Valuation Books?

Choosing the valuation books or valuation professionals to conduct appraisals and provide valuation reports is an important decision, as the accuracy and reliability of the valuation can have significant financial implications. Here are some steps and considerations to help you choose the right valuation books or professionals:

Determine the Purpose of Valuation:

Clearly define why you need a valuation. Are you valuing a business for a merger, a property for tax purposes, or an investment portfolio for financial planning? The purpose of the valuation will guide your selection process.

Identify the Type of Asset or Business:

Different assets and businesses may require different valuation expertise. Ensure that the valuator or valuation book has experience and expertise specific to the type of asset or business you need to value.

Check Qualifications and Credentials:

Verify the qualifications and credentials of the valuator or appraisal firm. Look for certifications such as Certified Valuation Analyst (CVA), Accredited Senior Appraiser (ASA), or Chartered Business Valuator (CBV), depending on the jurisdiction and type of valuation.

Experience and Expertise:

Assess the valuator's experience in conducting valuations similar to your specific needs. Experience in your industry or asset class is often crucial for accurate valuations.

Reputation and References:

Research the reputation of the valuation professional or firm. Seek references and testimonials from previous clients. Online reviews and industry reputation can also be informative.

Quality of Previous Work:

Review samples of past valuation reports or valuation books to gauge the quality of their work. Ensure that their reports are comprehensive, well-documented, and compliant with relevant standards.

Fee Structure:

Understand the fee structure for the valuation services. Compare quotes from multiple valuation professionals or firms to ensure that you are getting a fair and competitive price.

Methodology and Approach:

Discuss the methodology and approach the valuator will use to assess the value. Make sure it aligns with industry standards and best practices. Transparency in their approach is essential.

Communication and Rapport:

Establish open and effective communication with the valuator. A good rapport and clear communication are important throughout the valuation process.

Confidentiality and Data Security:

Ensure that the valuator has robust data security and confidentiality protocols in place, especially when dealing with sensitive financial information.

Compliance and Regulation:

Confirm that the valuator is aware of and complies with all relevant laws and regulations governing valuations in your jurisdiction. This is crucial for tax-related valuations and financial reporting.

Timeline and Deliverables:

Discuss the expected timeline for completing the valuation and receiving the valuation report. Ensure that the valuator can meet your deadlines.

Conflict of Interest:

Inquire about any potential conflicts of interest that the valuator may have that could compromise the objectivity of the valuation.

Client References:

Ask for references from previous clients who have had similar valuation needs. Contact these references to inquire about their experiences and satisfaction with the valuator's services.

Contract and Engagement Agreement:

Once you've selected a valuator, ensure that you have a clear and comprehensive engagement agreement that outlines the scope of work, fees, timelines, and responsibilities of both parties.

Choosing the right valuation books or professionals requires careful consideration and due diligence. Taking the time to evaluate your options and select a qualified and reputable valuator is essential for obtaining accurate and reliable valuation reports.

In conclusion

Overall, valuation books are valuable tools that provide clarity, transparency, and credibility in a wide range of financial and business transactions, ultimately leading to better decision-making and risk management.

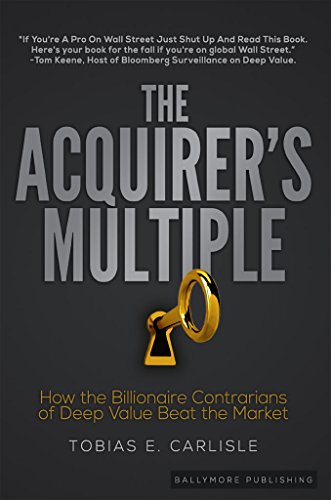

If you are finding where to buy valuation books, you can go to Amazon. But in Amazon has many products, and you will meet a trouble to choose the best product. Don’t worry! We help you. We have top featured products which highly appriciate. That wonderfull suggession for you. Try and Buy it now!

I’m Jane Smith, editor at best2buy.reviews. If you have any questions, please feel free to let me know. I’m always availabe to respone any your questions.